Save more.

Spend less.

Stretch your dollars.

Becoming financially healthy is a great goal for 2024 and beyond – and Ben E. Keith has the programs and resources to make your financial health a reality.

Flexible Spending Accounts (FSAs) from Optum

Enroll in an FSA and stretch your paycheck by using pre-tax dollars to pay for eligible dependent and health care expenses. Ben E. Keith offers two kinds of FSAs. Enroll in one (or both) FSAs for 2024.

Dependent Care FSA

- Use for daycare, nursery school, pre-school, after school, day camp for eligible children under age 13 or senior daycare for aging parents.

- Contribute up to $5,000 pre-tax dollars each calendar year.

- Decide on an amount to contribute from each paycheck using this FSA Worksheet and list of eligible expenses.

- Funds are available as soon as they are deducted from your paycheck.

- Any unused FSA dollars at the end of the year can be reimbursed to pay for 2024 eligible expenses through March 15th, 2025.

Health Care FSA

- If you enroll in the BEK PPO Medical Plan, use your health care FSA debit card to pay for eligible medical, dental and vision expenses including deductibles, coinsurance, copays, prescriptions and over-the-counter medications.

- If you enroll in the BEK HSA Medical Plan, use money in your health care FSA to pay for eligible dental and vision expenses only. You must submit your expenses for reimbursement. You will not receive a debit card.

- Contribute up to $3050 using pre-tax dollars each calendar year.

- Your entire 2024 annual contribution amount is available to use on January 1st, 2024.

- Decide on an amount to contribute from each paycheck using this FSA Worksheet and list of eligible expenses.

- You can carry over up to $610 in unused FSA dollars to the following year.

Life/AD&D from Lincoln Financial Group

BEK-paid Basic Life/AD&D Insurance

Full-time employees automatically receive $50,000 in term life insurance:

- Provides lump sum benefits if you die.

- Provides a benefit if you lose a limb or suffer paralysis in an accident.

BEK Supplemental Life/AD&D

- Choose $50,000 to $950,000 in coverage in $50,000 increments.

- If you leave BEK, you can take this coverage with you when you continue to pay premiums directly to Lincoln Financial Group.

- If you enroll during your initial enrollment period, you are guaranteed coverage up to $300,000.

- Amounts over $300,000 will require Evidence of Insurability (EOI) and must be approved by Lincoln Financial Group to be effective.

- Rates are based on the age of the employee as of January 1st, 2024.

BEK Spouse Life/AD&D

What you need to know:

- Choose a coverage amount of $50,000 to $250,000 in $50,000 increments.

- Spouse coverage can be up to 100% of the employee life/AD&D amount, not to exceed $250,000.

- Amounts over $50,000 require Evidence of Insurability (EOI) and must be approved by Lincoln Financial Group to be effective.

- Rates are based on the age of the employee as of January 1st, 2024.

BEK Child Life/AD&D

What you need to know:

- Each child receives $10,000 in life/AD&D coverage except from birth to 14 days old, which provides $1,000 in coverage.

- Children up to age 26 can be covered.

- You may enroll unmarried dependent children age 26 or older who are incapable of self-care due to a mental or physical disability. They must be fully dependent on you for support and claimed on your federal tax return.

- Be sure to list the names of each child during enrollment when requested; otherwise, they will not have coverage.

- Pay the same low rate of $1.50 a month—no matter how many children you enroll.

Visit Lincoln Financial Group at mylincolnportal.com and use Company code BEKCO or call 1-888-408-7300.

401(k) from Empower Retirement Group

In 2024 you can save up to $23,000 of your pay in the BEK 401(k). How much should you be putting away for retirement? At least 4%, of course! Why? Because Ben E. Keith contributes one dollar for each dollar you save, up to 4% of your pay. So if the convenient payroll deductions and potential tax advantages don’t get you into the plan, the Company match should.

If you don’t elect a contribution rate, you will be automatically enrolled as soon as you are eligible at a contribution rate of 4% of your pay.

Who can participate?

Full-time and part-time employees are eligible to participate in the 401(k) on the first day of the month following 60 days of service. You must be under age 55 or have less than one year of Company service as of July 1st, 2018 to participate in the 401(k).

When participation begins

You can start contributing to your 401(k) on the first day of the month following 60 days of service if you were hired on or after July 1st, 2018. Each pay period, money will be deducted from your paycheck at a pre-tax contribution rate of 4% of your pay unless you go to empowermyretirement.com and indicate what amount you prefer before the 1st day of the month following your 60th day of employment. You can increase, decrease or stop your contributions at any time.

More about Company contributions

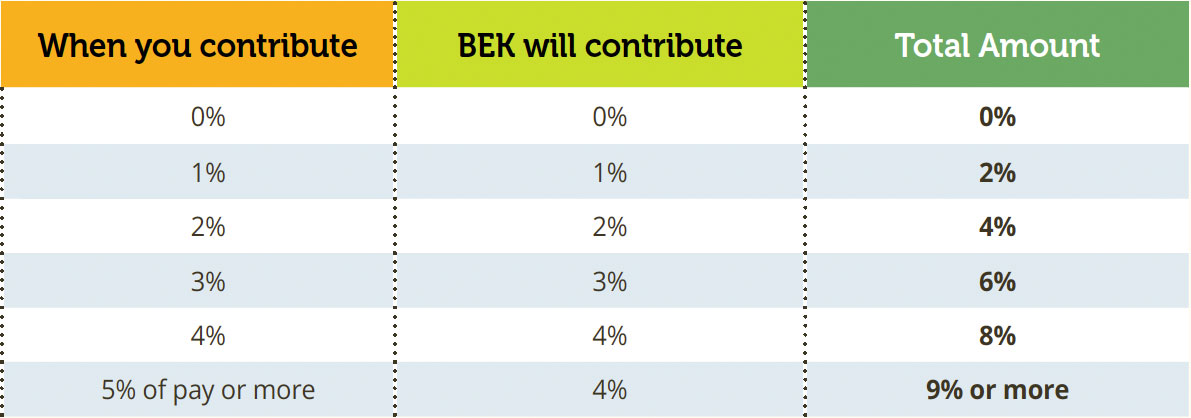

Get the $1 for $1 Company match up to 4% of your pay. How it works:

We’ll help you get started

You can choose your own contribution rate any time. However, if you don’t get around to enrolling or choosing an amount, we’ll automatically enroll you at a contribution rate of 4% of your pay. Prefer a different amount or want to change or stop your contributions? Go to empowermyretirement.com.

Age 50 or older in 2023?

The IRS allows you to contribute an additional $7,500 in “catch-up” contributions, up to the 2024 limit of $30,500. This helps you save even more for your retirement.

Vesting is simple

“Vesting” is the point in time when you “own” the dollars in your 401(k). You are 100% vested in any BEK matching contributions (and any earnings) after two years of Company service. Your personal contributions are always 100% vested.

Rollovers are welcome

You can roll over dollars from a qualified retirement plan or IRA into your 401(k) account. We suggest you consult your personal financial advisor or Empower Retirement at empowermyretirement.com or call 1-833-BEK-SAVE (1-833-235-7283).

Have questions? Need help?

Contact Empower Retirement at empowermyretirement.com or call 1-833-BEK-SAVE (1-833-235-7283).

Profit Sharing

Ben E. Keith is extremely proud to have contributed millions of dollars to the BEK Profit Sharing accounts of our employees in the last 15 years.

Profit Sharing dollars from Ben E. Keith, along with your 401(k) savings, will help you be on your way to a comfortable retirement

Who can participate?

Full- and part-time employees with 1 year of Company service who have worked a minimum of 1,000 hours are eligible for a Profit-Sharing contribution if BEK makes a discretionary contribution.

How your account is invested

We will automatically invest dollars in your account in a State Street Target Date Fund based on your retirement age. Or, you can choose funds that better meet your personal investment strategy if you prefer.

You can choose the same (or different) funds for your 401(k) account.

Vesting is simple

Your Profit Sharing contributions from Ben E. Keith are 100% vested after six years of service:

- 20% after year 2

- 40% after year 3

- 60% after year 4

- 80% after year 5

- 100% after year 6

Have questions? Need help?

Contact Empower Retirement at empowermyretirement.com or call 1-833-BEK-SAVE (1-833-235-7283).

Financial wellness from SmartDollar

When you utilize the tools on smartdollar.com/enroll/benekeith, you and your family make actual progress with money – not just live paycheck to paycheck. By focusing on one goal at a time, you build momentum to move through the plan and make lasting changes like:

- Saving for emergencies.

- Getting out of debt.

- Retiring with confidence.

Go to smartdollar.com/enroll/benekeith and use the EveryDollar tool to learn where you stand.

Employee discounts from PerkSpot

Get great travel deals, entertainment tickets and fitness savings when you use PerkSpot.

PerkSpot is easy to use. Just create an account then log in and shop. Enter your discount code as needed when you check out. You can create your own “favorites” list and search for discounts in your neighborhood.

Get travel deals, entertainment tickets, great gifts, fitness items and practical everyday necessities—all online at specially negotiated discounted prices. It’s an easy way to stretch your paycheck. Create an account at benekeith.perkspot.com and use access code bekperks to start saving.

Educational Assistance Program

Ben E. Keith provides full-time employees with 6 months employment with financial assistance for tuition, fees and books related to qualified degree programs. Ben E. Keith may reimburse you up to a maximum of $5,250 per calendar year when you attend an accredited 2- or 4-year institution. You must receive a passing grade of C or higher, or receive a “Pass” if the course is “Pass/Fail.”

Continuing (or starting) your education with the help of Ben E. Keith Company is a great way to develop your career.

How to apply

- Complete the one page application then submit to education@benekeith.com by the below deadlines.

You’ll need to provide details about your degree and anticipated financial request. Your manager must sign your application and you must be in good standing to be eligible. You will need Adobe Acrobat Reader to view and complete the form. Applications should be submitted no later than:- July 15th for Fall semester.

- November 15th for Spring semester.

- April 15th for Summer semester.

If the deadline falls on a weekend, the deadline will be the following Monday.

- The Educational Review Committee will review applications shortly after the deadline. You’ll be notified of whether you are accepted into the program within four weeks.

- You will be reimbursed each quarter for approved expenses, including tuition, fees, and books after you submit receipts. In addition, you must provide documentation such as a transcript that shows you have received a passing grade of C or higher, or received a “Pass” if the course is “Pass/Fail.”

- If accepted into the program, you must submit your invoice/receipts for reimbursement within 60 days of completing each semester’s coursework.

For additional details, review the Educational Assistance Program Policy.

BEK Credit Union

As a Ben E. Keith employee, you and your eligible family members can join the BEK Credit Union at bekefcu.org or 1-817-759-6300.

Members have access to:

- Auto, boat, motorcycle and personal water craft loans and refinancing.

- Christmas Club & Vacation Savings accounts.

- Debt consolidation loans.

- Credit cards.

- Payroll deductions for loans and savings accounts.

- Loans for back-to-school, home repairs and more.

- Referrals to mortgage loan providers.

Thinking about retirement?

- Get help choosing and enrolling in Medicare coverage from Via Benefits.

- Retiree checklist.

- Retiree handout.