Helpful info to know

Direct deposit

You can have your paycheck directly deposited into any checking or savings account. Go to the menu bar on Dayforce and select Forms > Direct Deposit

Payroll deductions

The amount shown on your paycheck is after federal, state, local and Social Security taxes are deducted. BEK also withholds other deductions you approve or enroll in, such as 401(k) contributions and/or benefits coverage.

Pay dates

Generally, hourly (non-exempt) employees are paid on a weekly basis and salaried (exempt) employees are paid on a semi-monthly basis. Commissioned sales employees are paid monthly.

Request time away from work

Go to Dayforce and select Time Away List to request time off or see your accrued balance.

Update address

You can update your personal information including home address and emergency contact on Dayforce and select Forms > Contact Details.

Changing coverage during the year

Go to Dayforce and select Forms > Life Event Declaration if you experience a life event like having a baby or getting married. You must submit a Life Event Change on Dayforce within 31 days of the event if you want to add/delete or change coverage.

To change your W-4 form

Go to the menu on Dayforce and select Forms > Federal W-4

Who can enroll, when to enroll and covering family members

Eligible dependents include

- Your spouse. If you and your spouse are both Ben E. Keith employees, you can enroll as a dependent or as a primary insured person, but not both.

- Your or your spouse’s children, up to age 26, including a natural child, stepchild, legally adopted child, foster child, natural grandchild for whom you have legal guardianship, a child placed for adoption, or a child your spouse is the legal guardian of.

- An unmarried child age 26 or older who is incapable of self-care due to a mental or physical disability.

- A child you are required to provide coverage for, due to a Qualified Medical Child Support Order, or any other court or administrative order.

When to enroll and when coverage begins

If you want benefits coverage, you must enroll by the 1st day of the month following your 60th day of employment, (or 30th day for KVPC Southeast employees). If you enroll, coverage for you and any dependents begins on the 1st day of the month following your 60th (or 30th) day at Ben E. Keith.

If you want to cover family members

If you enroll your eligible dependents, you must provide any requested documentation to prove the people you want to cover are related to you. Review the list of acceptable dependent verification documents.

In a word, family is what Ben E. Keith is all about. And like any extended family, ours is a diverse workforce that needs a wide range of benefits. Learn more about the plans and programs available to you and your family in 2024 by clicking on a topic below.

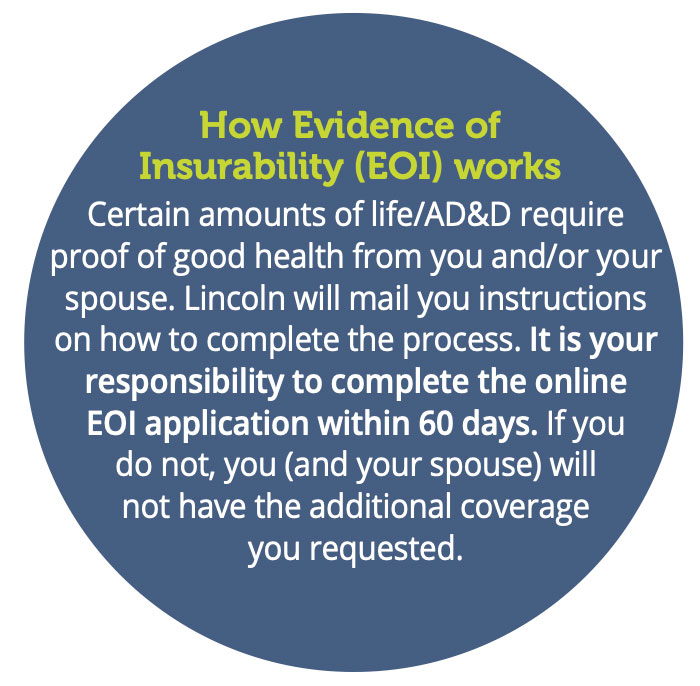

Life/AD&D from Lincoln Financial Group

mylincolnportal.com Company code BEKCO or call 1-888-408-7300.

All full-time employees automatically receive $50,000 of Company-paid BEK Basic Life/AD&D. You don’t need to enroll and there is no cost to you. You do, however, need to name a beneficiary to make sure the person you want to receive your benefits, gets them.

BEK Life/AD&D coverage is provided by Lincoln Financial Group. Find life/AD&D rates on Dayforce.

Choose additional coverage for you and your family including:

- BEK Employee Supplemental Life/AD&D

Choose $50,000 to $950,000 in increments of $50,000. Rates are based on the age of the employee as of January 1st. EOI (Evidence of Insurability) is required if you increase your coverage by more than $50,000 or increase to a coverage amount greater than $300,000. - BEK Spouse Life/AD&D

Choose $50,000 to $250,000 in increments of $50,000. Spouse coverage is available in amounts up to 100% of your selected Employee Supplemental Life/AD&D coverage but cannot be greater than $250,000. EOI (Evidence of Insurability) is required if you increase your current coverage to an amount greater than $50,000. Rates are based on the age of the employee as of January 1st. - BEK Child Life/AD&D

Pay one amount no matter how many children you cover, up to age 26. Each enrolled child will have $10,000 in coverage except from birth to 14 days old, which provides $1,000 in coverage. You may enroll dependent children up to age 26 or older if incapable of self-care due to a mental or physical disability.

Resources to help you

- 2024 New Hire Benefits Summaries for BEK employees in English / Spanish, Food – KVPC Southeast employees, and part-time employees.

- Learn “Which type of doctor visit is right for me?”

- FSA Worksheet and list of eligible dependent care and health care expenses.

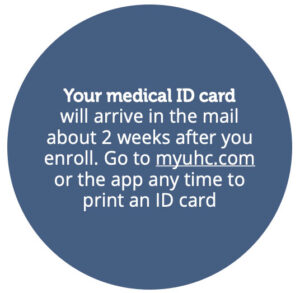

- Who gets an ID card and when.

- Learn how to access Dayforce.

Medical

Coverage to help you stay healthy

Ben E. Keith provides two types of medical plans:

- PPO – you’ll pay a copay when you see a provider or fill a prescription.

- HSA – this high-deductible health plan comes with a $1,000 tax-free Company contribution into a Health Savings Account (HSA) when you enroll in employee only coverage. If you cover your family, you’ll receive a $2,000 Company contribution. You can also contribute your own tax-free money into your HSA, up to the 2024 IRS limits, to pay for eligible expenses like deductibles, dental or vision care. Use HSA dollars to pay for eligible medical expenses like these.

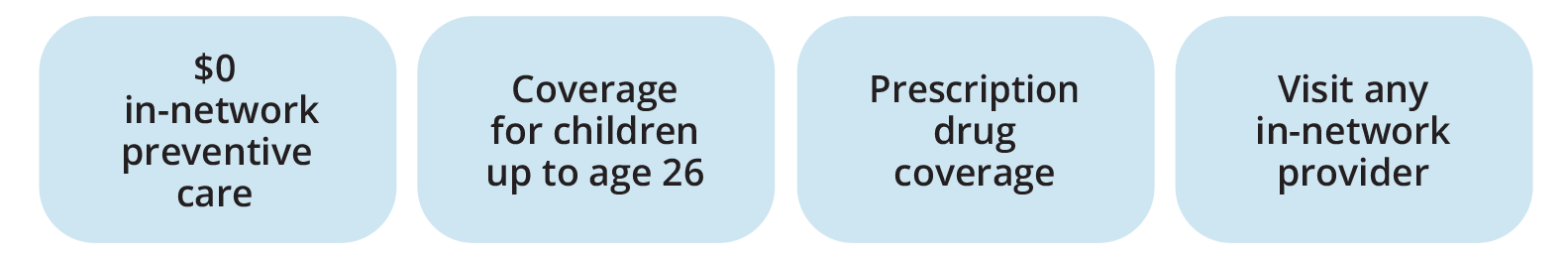

Both medical plan options provide you and your dependents with:

You’ll pay less if you use in-network providers. Find a list on myuhc.com.

You will pay more for coverage if either of these surcharges apply to your personal situation:

- Spousal surcharge

If your spouse is currently working and eligible for medical coverage through his or her employer but you want to cover them on your BEK medical plan, you will pay $100 a month more in addition to the medical costs per pay period. - Tobacco surcharge

You’ll pay $100 more per month if YOU (the employee) enroll in a BEK medical plan and use tobacco in any form – cigarettes, e-cigarettes, cigars, pipes, snuff or chewing tobacco. If you use tobacco now but want to quit, call QuitLogix at 1-855-372-0040.

![]() UnitedHealthcare at myuhc.com or 1-844-587-8503 (Download app for Apple / Android)

UnitedHealthcare at myuhc.com or 1-844-587-8503 (Download app for Apple / Android)

BEK Health Care FSA

- If you enroll in the BEK PPO Medical Plan, use your health care FSA debit card to pay for eligible medical, dental and vision expenses including deductibles, coinsurance, copays, prescriptions and over-the-counter medications.

- If you enroll in the BEK HSA Medical Plan, use money in your health care FSA to pay for eligible dental and vision expenses only. You must submit your expenses for reimbursement. You will not receive a debit card.

- Contribute up to $3,050 using pre-tax dollars in 2024.

- Your entire 2024 annual contribution amount is available to use on January 1st, 2024.

- Decide on an amount to contribute from each paycheck using this FSA Worksheet and this list of eligible expenses. You can carry up to $610 in unused FSA dollars to use the following year.

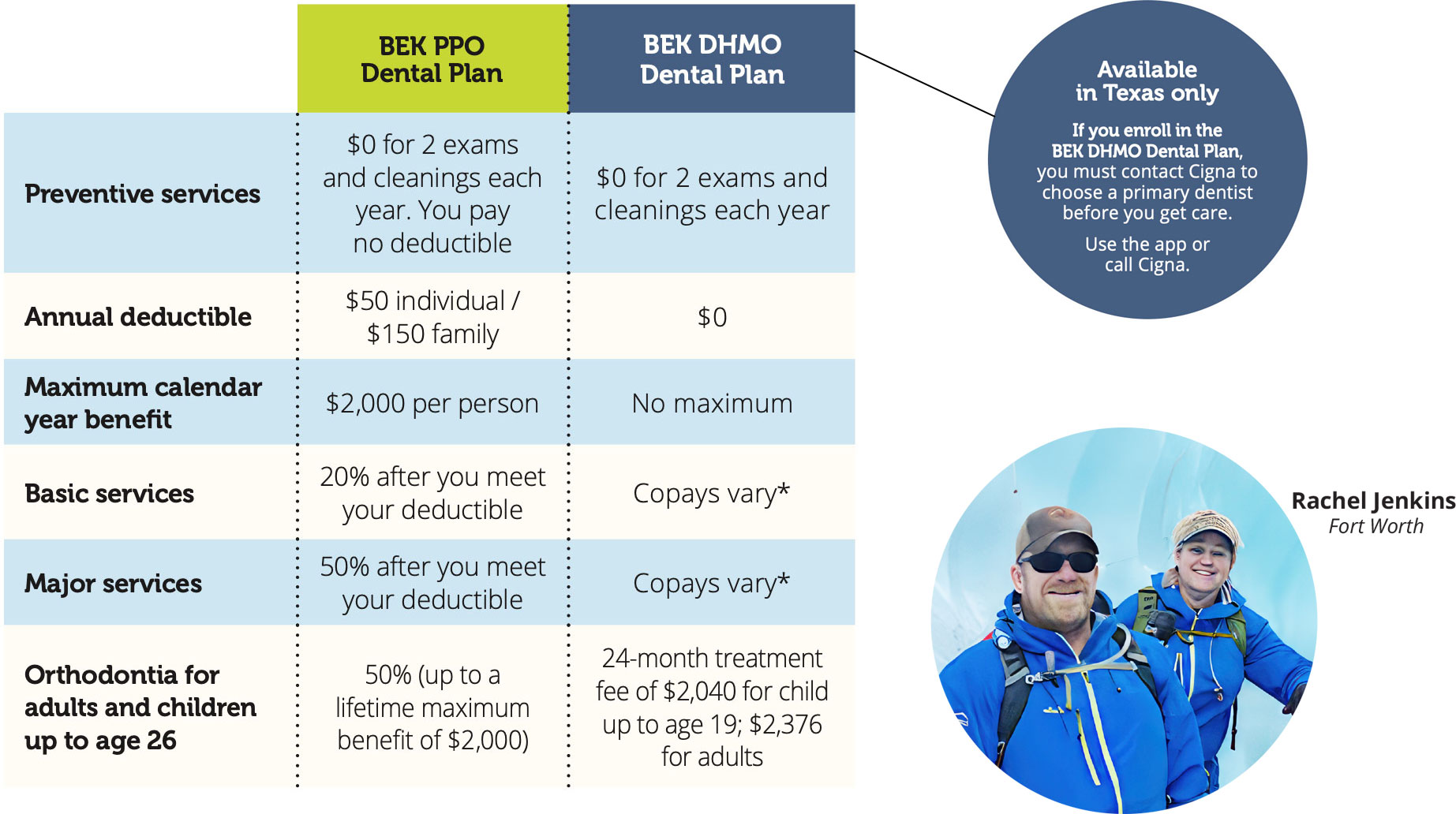

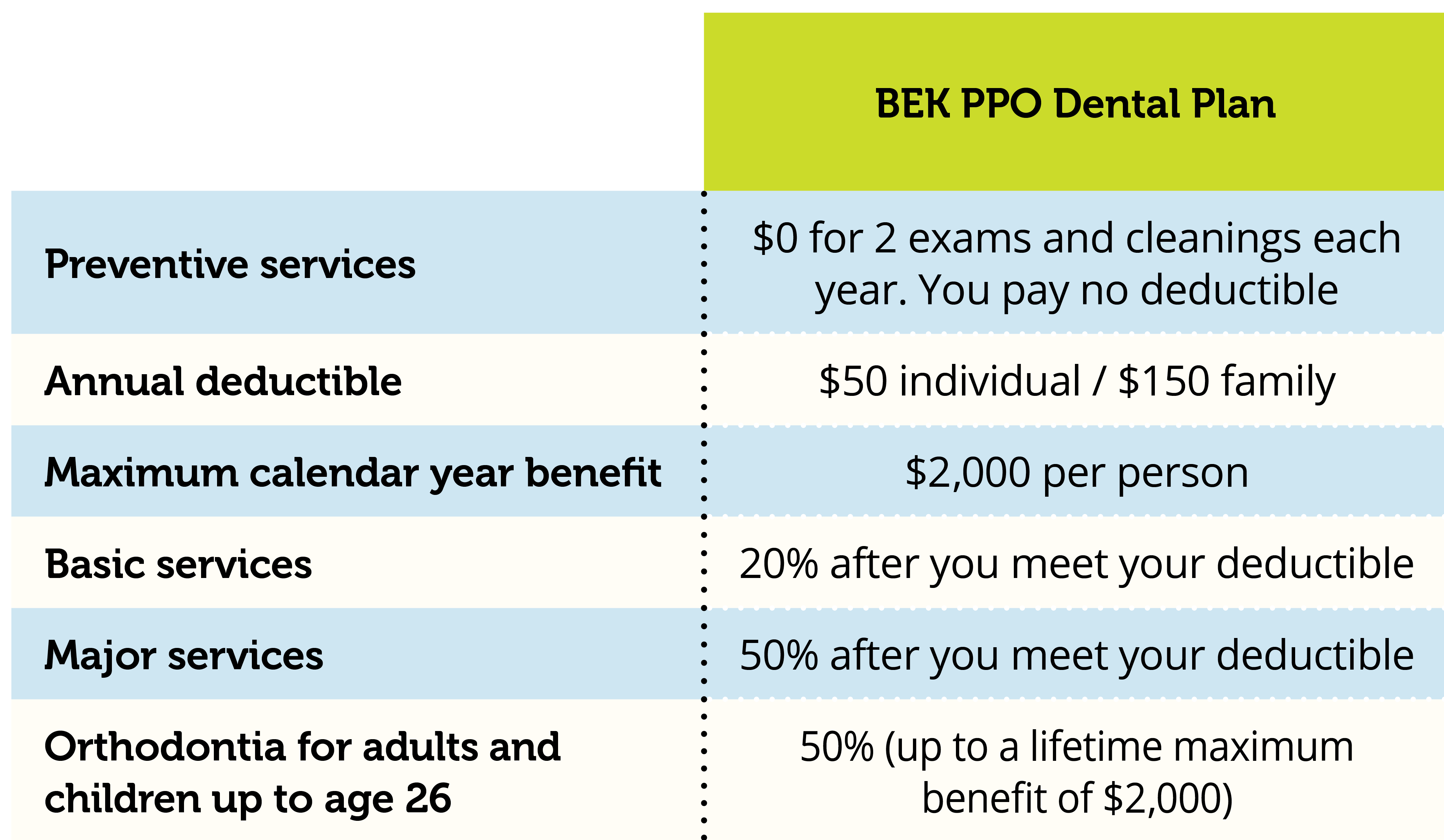

Dental from Cigna

mycigna.com or call 1-800-244-6224

The BEK Dental Plan from Cigna offers routine dental care, X-rays, basic and major care. Log in to mycigna.com or use the Cigna app to find a dentist and pricing.

BEK Dependent Care FSA

- Use for daycare, nursery school, pre-school, after school, day camp for eligible children under age 13 or or senior daycare for aging parents.

- Contribute up to $5,000 pre-tax dollars each calendar year.

- Decide on an amount to contribute from each paycheck using this FSA Worksheet and this list of eligible expenses.

- Funds are available as soon as they are deducted from your paycheck.

- Any unused FSA dollars at the end of the year can be reimbursed to pay for 2024 eligible expenses through March 15th, 2025.

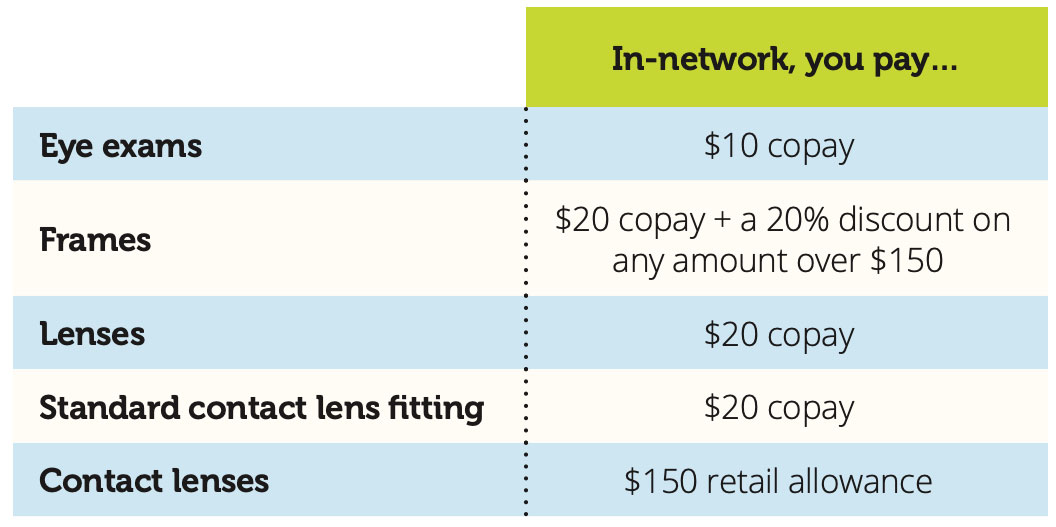

Vision from Superior Vision by MetLife

metlife.com/vision or call 1-833-393-5433

Regular eye exams keep you safe, screen for common vision problems and other conditions. Making an eye exam part of your 2024 is a great way to stay healthy. The BEK Vision Plan from Superior Vision by MetLife also covers frames and lenses or contacts. Go to metlife.com/vision to find a provider.

BEK Health Care FSA

- If you enroll in the BEK BCBS Medical Plan, use your health care FSA debit card to pay for eligible medical, dental and vision expenses including deductibles, coinsurance, copays, prescriptions and over-the-counter medications.

- Contribute up to $3,050 using pre-tax dollars in 2024.

- Your entire 2024 annual contribution amount is available to use on January 1st, 2024.

- Decide on an amount to contribute from each paycheck using this FSA Worksheet and this list of eligible expenses. You can carry up to $610 in unused FSA dollars to use the following year.

BEK Dependent Care FSA

- Use for daycare, nursery school, pre-school, after school, day camp for eligible children under age 13 or or senior daycare for aging parents.

- Contribute up to $5,000 pre-tax dollars each calendar year.

- Decide on an amount to contribute from each paycheck using this FSA Worksheet and this list of eligible expenses.

- Funds are available as soon as they are deducted from your paycheck.

- Any unused FSA dollars at the end of the year can be reimbursed to pay for 2024 eligible expenses through March 15th, 2025.

Dental from Cigna

mycigna.com or call 1-800-244-6224

The BEK Dental Plan from Cigna offers routine dental care, X-rays, basic and major care. Log in to mycigna.com or use the Cigna app to find a dentist and pricing.

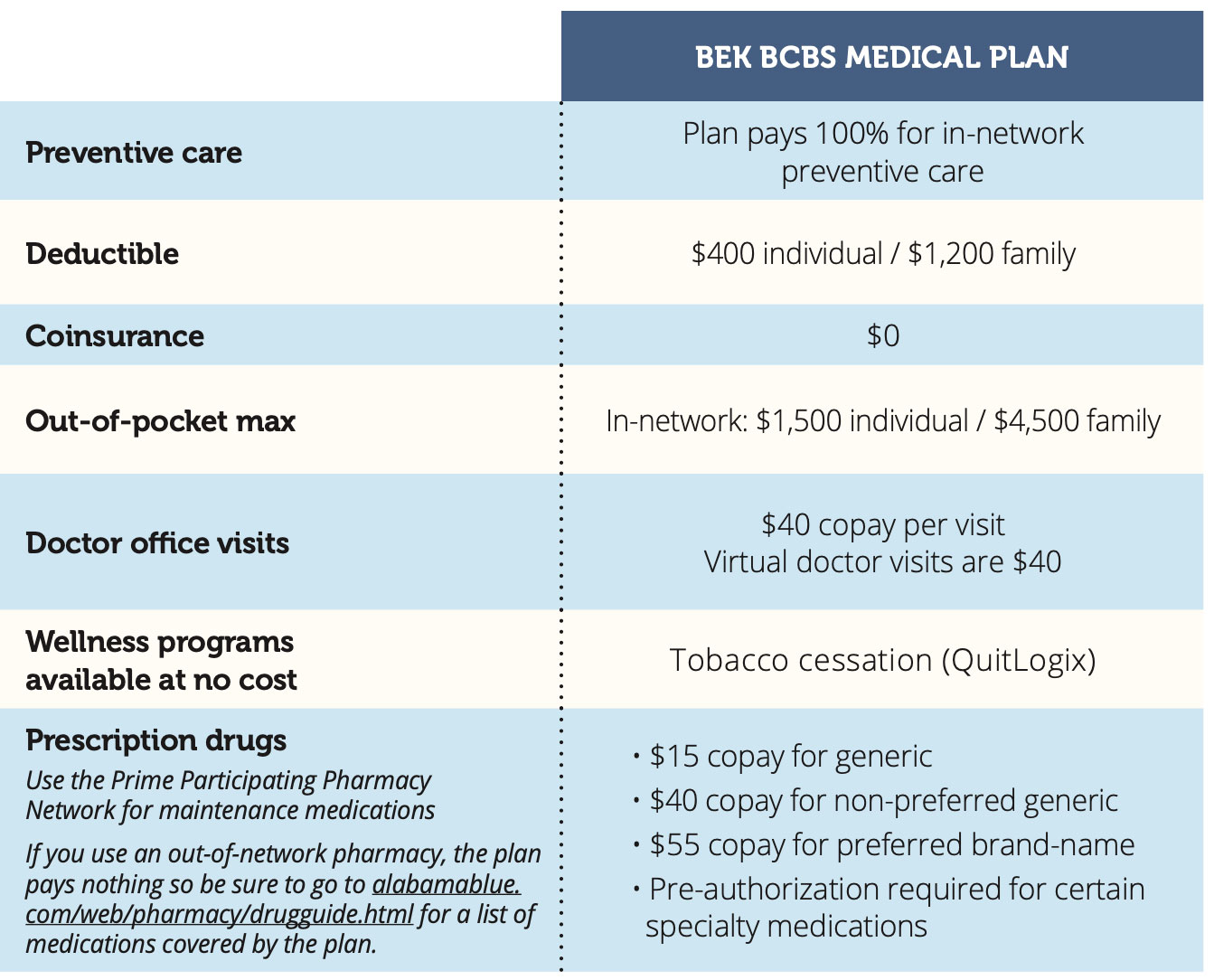

Medical

Ben E. Keith offers comprehensive medical coverage from BlueCross BlueShield of Alabama. The BEK BCBS Medical Plan provides you and your dependents with:

FYI, you’ll pay more for out-of-network care. Find a list of providers and information about non-network benefits on alabamablue.com.

You will pay more for coverage if either of these surcharges apply to your personal situation:

- Spousal surcharge

If your spouse is currently working and eligible for medical coverage through his or her employer but you want to cover them on your BEK medical plan, you will pay $100 a month more in addition to the medical costs per pay period. - Tobacco surcharge

You’ll pay $100 more per month if YOU (the employee) enroll in a BEK medical plan and use tobacco in any form – cigarettes, e-cigarettes, cigars, pipes, snuff or chewing tobacco. If you use tobacco now but want to quit, call QuitLogix at 1-855-372-0040.

BlueCross BlueShield of Alabama at alabamablue.com or 1-800-292-8868 (Download app for Apple / Android)

Have questions or need help? Talk to your HR Manager or Office Manager.

Congratulations on making a great career choice, and welcome to Ben E. Keith!